Finance

Know Why ULIPs Do Not Invest Only In Equities?

As ULIPs are becoming common among investors, more people are learning about the benefits that they can enjoy with this product. ULIP is ...

Finance

Check Out Some Of The Best Sips For Long Term Financial Goals

Mutual funds (MFs) offer an extensive range of plans to meet your different needs when building money for long-term financial goals. You can ...

Finance

Here are some quick tips to open a savings account on a bank app

People use the Internet, smartphones, and mobile apps to get anything online without going out. Mobile bank applications offer several features that help you do ...

Finance

How to Trade Commodities in Australia?

Commodities include raw materials or agricultural products that you can buy and sell. They have an active market where prices change daily depending ...

Finance

Understanding Your Credit Report

This infographic was created by Stein Saks, a credit reporting lawyer

Finance

5 Amazing Features An Accounting Software Offers You

Scores of companies – large, medium, small, startup, and industry veterans – have upgraded to accounting software over the past few years. In ...

Finance

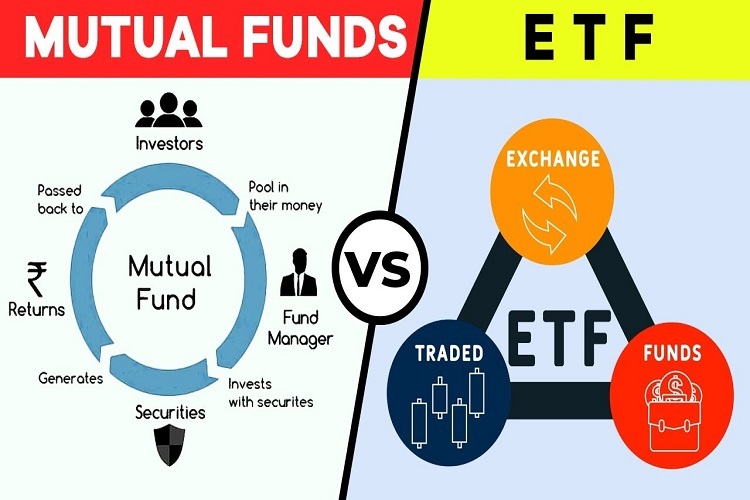

Know the difference between ETF & mutual funds

As consumers, we like to be spoilt for choices. Be it shopping online for shoes or online grocery shopping or buying a mutual ...

Finance

Ways to Cut Your Expenses and Save Money

When it comes down to it, household debt is a major concern for many families across the country. In the first quarter of ...

Finance

Personal Finance Woes: Should You Hire an Accountant for Personal Finances?

While businesses are required by law to maintain financial books and records, individuals are not. However, not doing so is more likely to ...

Finance

6 Tips and Tricks For Leverage Trading In Crypto

After hearing so much about cryptocurrency in the news or social media, it is easy for people to get allured. But most people ...

Most Viewed

Key Differences of Hedge Funds vs Hard Money Loans

How Much Annuity To Sell And Save The Benefits

Stay Safer Side Of Finance By Taking Insurance

About Binary Option and Finance

Financing Your Home Buying Plans And Finding The Perfect Home

Lawsuit Settlement Loans – Asking the Right Questions

Simple Efforts for Profitable Binary Options Trading

Plan A Loan With Mortgage Calculator

Structure Settlement An Important Element To Secure Your Life

Why To Get The Latest Application For Brim

Essential Instructions For The Beginners In The Binary Trading

The Need Of A Loan Calculator For Anyone Requiring Loan