Leverage is one of the most talked-about features in CFD trading. It allows traders to control larger positions using a small part of their own money. For some, it opens the door to bigger profits. For others, it brings fast and unexpected losses. Understanding how it works is important if you want to trade with more control and less risk.

When you use leverage, you only need to deposit a percentage of the total trade value. This deposit is called margin. For example, if you want to open a trade worth £1,000 and your broker requires 10% margin, you only need £100 in your account. The rest is covered by the broker. If the trade moves in your favour, you make a profit based on the full £1,000. But if it goes against you, your losses also grow at the same rate.

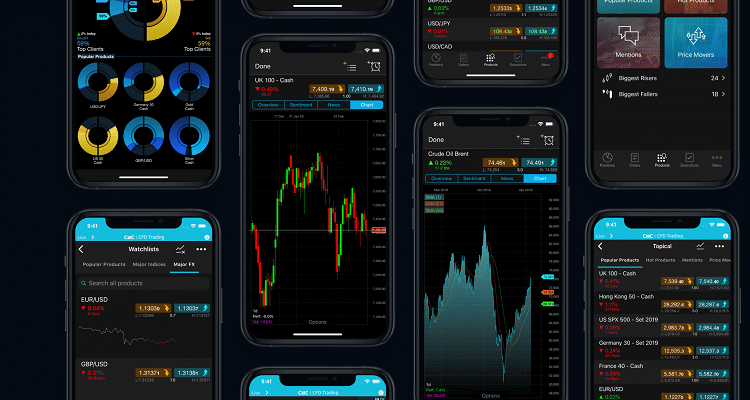

Online CFD trading platforms often show the leverage ratio clearly. Some offer 10:1, others 30:1 or more, depending on the asset and local rules. The higher the ratio, the greater the impact on your account—both positive and negative. That’s why many traders have mixed feelings about it. It can be your best tool or your biggest risk.

One common mistake is using high leverage without a clear plan. Traders sometimes see a small move in the market and open large positions, hoping for a quick win. If the market shifts slightly in the wrong direction, the trade can close automatically, wiping out a big part of the account. This often happens before there’s even time to react.

It’s also important to know that leverage doesn’t change the market itself. Prices still move the same way whether you use it or not. What changes is how those movements affect your account. A move of just 1% might seem small, but with high leverage, that can mean a major swing in profit or loss.

In online CFD trading, traders are usually given tools to help manage this. Stop-loss and take-profit levels can be set to control how much is gained or lost on each trade. These tools are helpful when used properly. They allow you to plan your trades rather than rely on hope or luck.

Some traders prefer to use low or no leverage, especially in the beginning. This gives them time to study the markets and understand how different assets behave. Once they feel more confident, they may slowly increase their trade size or use more margin. Building up experience this way often leads to better long-term results.

Another factor to keep in mind is market volatility. When prices move quickly, the effects of leverage are stronger. This is why some brokers reduce the leverage they offer on assets that are known to be highly unstable. It helps protect traders from large, sudden losses.

For those who want to use leverage wisely, planning matters. It’s not just about how much money you can make. It’s about how much risk you’re comfortable with and how well your strategy handles both winning and losing trades.

The role of leverage in online CFD trading will always spark debate. Some view it as a helpful tool, while others treat it with caution. Both views are valid, depending on how it’s used. The key is to understand that leverage can only help if the rest of your trading habits are solid. Without discipline, even a small position can lead to big losses.

In the end, leverage is neither good nor bad. It’s a tool—one that needs to be handled with care. When used wisely, it can support your strategy and make your trades more effective. But if misused, it can turn a simple trade into an expensive lesson.

Comments