As consumers, we like to be spoilt for choices. Be it shopping online for shoes or online grocery shopping or buying a mutual fund scheme, the more options one has the better buying decision one can make. Yes, even with mutual funds one has a plethora of opportunities to choose from. But for someone new to the world of mutual fund investing, knowing that there are thousands of schemes to choose from can be a bit overwhelming. Although mutual funds are easy to invest in, multiple schemes almost possess similar traits and one may end up investing in a scheme that doesn’t align with their investment objective and their risk appetite.

To avoid this, prospective investors can do some basic research, understand the different schemes available, seek professional consultation if necessary, watch some informational videos and then make an informed investment decision.

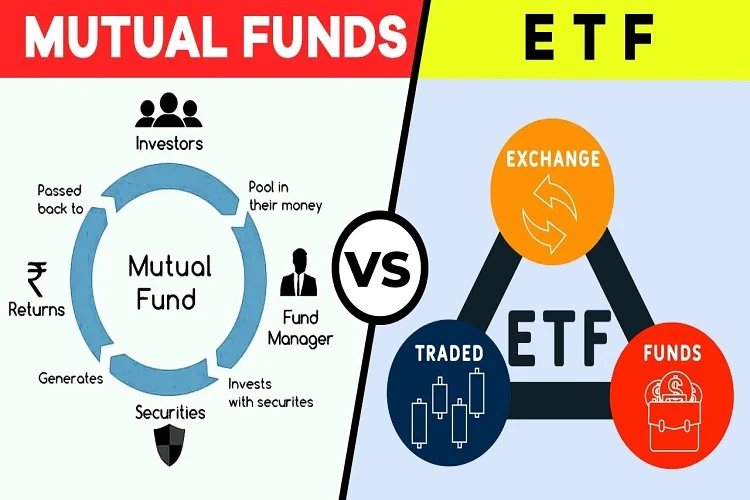

If you have heard about ETFs and wondering how they are different from other mutual fund schemes, this article aims to understand the major differences between these two.

What is a mutual fund?

A mutual fund is an investment vehicle that pools financial resources from investors sharing a common investment objective and invests the sum accumulated across money market instruments and various asset classes. Mutual funds aim to generate capital appreciation through diversification and try to offer risk-adjusted returns over the long term. Investors can buy mutual fund units at their NAV which is determined at the end of the day.

What is an ETF?

Exchange Traded Funds or ETFs are open-ended schemes that predominantly invest in their underlying benchmarks. Their investment objective is to generate returns by mimicking the performance of their underlying index with minimal tracking error. These funds invest in the underlying securities in the same way as they are held in the underlying index. These funds follow a passive investment strategy and do not have the active participation of the fund manager.

Mutual funds v/s ETFs: What’s the difference?

| Particulars | ETFs | Mutual Funds |

| Flexibility | ETFs are highly flexible in nature and can be traded at their current market value during live trading hours | Mutual funds can be bought or sold by placing an order to the AMC based on the NAV which is determined at the end of the day |

| Expense ratio | ETFs do not need active management for their portfolio. They are passively managed funds where the fund manager reshuffles the portfolio from time to time so that the scheme is aligned in quantum with its underlying index. Since these are passive funds, they have a relatively low expense ratio | Mutual funds have designated fund managers that actively buy and sell securities to help the scheme achieve its investment objective. They actively buy and sell securities to leverage from the current market conditions and since these are actively managed funds, they have a high expense ratio as compared to ETFs |

| Lock in period | ETFs do not have any lock in period because of which one can buy or sell them at any given time | Not all mutual funds come with lock-in period but some equity mutual funds like ELSS (Equity Linked Savings Scheme) come with a statutory lock-in period of three years |

If you have decided whether you want to invest in mutual funds or ETFs, you can start your investment journey with SIP. Systematic Investment Plan (SIP) is an effective investment tool that allow investors to save and invest regularly. One can also refer to SIP calculator to calculate the total returns that they will earn by investing in mutual funds/ETFs at the end of their investment journey.

Comments